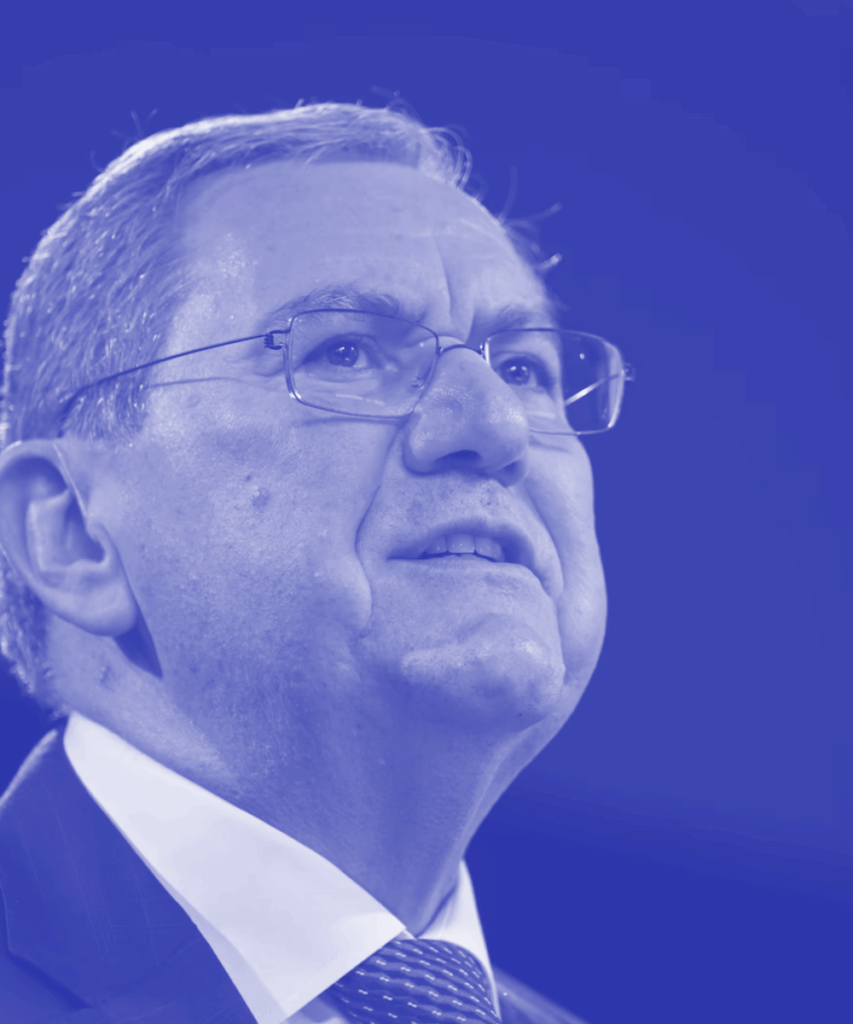

Green Street Q+A: Andrew Torrington on building a transparent and risk-averse private credit business

The veteran lender said his success is built on discipline and deep property market expertise by Larry Schlesinger.

ASIC’s plans to crack down on risky lending practices in the $200bn private credit sector is welcomed by Andrew Torrington, who established Woodbridge Capital four years ago with “transparency, education and institutional-grade governance” at the heart of its business model. “Transparency standards vary widely across private credit managers, and that’s a problem,” he told Green Street News. “More oversight would protect investors and build confidence in the sector.” Apart from being risk-averse, Torrington credits his 20 years in the construction industry and a deep understanding of property development as key factors in the success of his lending business, which has registered zero loan impairments and helped many developers get their projects out of the ground. “We help solve problems, not create them.” Torrington spoke to Green Street News about the principles and strategies that have guided Woodbridge’s success and what makes his credit funds attractive to investors in an increasingly competitive private lending market.

What’s your backstory and why did you start Woodbridge Capital? I began my career in chartered accounting, but my real education came from spending over 20 years in the construction industry. That time gave me a deep, practical understanding of property, how it’s built, financed and managed. I later joined a high-net-worth family office focused on property, which led me to establish the Merricks Capital private credit business in 2017. We built a private credit business from the ground up and grew the loan book to $2bn. But as I spent more time in the private credit space, I saw how opaque it had become — hidden risks, questionable loans, layers of fees. It didn’t sit right with me. I saw an opportunity to do things differently. That’s why I founded Woodbridge in 2021 to bring transparency to private credit, backed by education and institutional-grade governance. We’ve built the business around non-blended funds, responsible investment, and a clear, no-nonsense approach.

How does Woodbridge stand out from other private lenders? We’re property people first. We are not bankers or commodity traders. That means we speak the same language as our borrowers, we understand the realities of real estate, and we’re direct. No fluff, no grey areas. We’re easy to deal with, and we get things done. We take a conservative approach to risk. We only do first mortgage (senior secured) loans, we don’t use fund leverage, and we maintain strict LVR and liquidity buffers. Our execution is fast and certain, and we hold ourselves to high standards through strong governance and disciplined investment processes.

What’s the investor appetite like for private credit right now? It’s strong and getting stronger. Investors are looking for yield and diversification beyond equities and bonds. Private credit, especially in commercial real estate, is becoming a core part of many portfolios. But investors are also becoming more selective. They want transparency, a solid track record, and managers who know what they’re doing. We’re seeing growing interest from institutions, and retail and wholesale investors.

Are you currently raising capital, and where is it coming from? Yes, we’re actively raising for both our wholesale and retail funds. The retail fund, in particular, is growing rapidly. We’re seeing strong support from financial advisers, investment platforms and direct relationships with high-net-worth investors. We’re also working with institutional mandates and co-investment partners who share our values.

Who are your borrowers and what kind of loans do you offer? We work with mid-market developers and property groups across Australia and New Zealand. Our loans typically range from $10m to $100m, and they’re always secured by a first mortgage. Right now, we’re mainly investing in residential apartments/townhouses and industrial, what we call “beds and sheds.” Our borrowers come to us because they value speed, certainty and a lender who helps solve problems, not create them.

How have your funds and loans performed? We’ve built a strong track record, no investor losses and consistent fund outperformance compared to our peers. That’s the result of conservative underwriting and monthly stress-testing that keeps risk tightly managed. We don’t chase volume. We focus on deals we can execute with confidence. Our success is built on discipline, transparency and deep property market expertise.

What’s the outlook for private CRE credit in Australia? It’s very promising. Banks are still cautious, which creates opportunities for nonbank lenders like us. Mid-market CRE borrowers are increasingly turning to private credit for certainty of funding. Demand is especially strong in the industrial and residential sectors. And if we follow the trajectory of the US and Europe, private credit in Australia is set to double its market share in the coming years.

Are rising risks in Australia a concern? We’re always vigilant. Macro risks like interest rates, construction costs and supply chain pressures are real. But our conservative structures, first mortgages, lower LVRs and liquidity buffers help us manage those risks. Discipline matters more than ever. Too many competitors stretch LVR too far or don’t truly understand real estate. We run monthly stress tests to make sure our portfolios stay robust, even in tough scenarios.

Does the industry need more oversight? Absolutely. Transparency standards vary widely across private credit managers, and that’s a problem. More oversight would protect investors and build confidence in the sector. At Woodbridge, we already apply institutional-grade governance voluntarily. Regulation should strike the right balance in protecting investors without stifling innovation.

How do you approach sustainability and responsible lending? For us, responsible investment and ESG go hand in hand. Responsible investment is integrated into how we assess credit and monitor loans. All our funds are RIAA-certified, which is something we are immensely proud of, and we actively prefer loans that deliver positive community and environmental outcomes. But our commitment goes beyond lending. Through Woodbridge Giving and Woodbridge Learning, we’re investing in impact — financially, socially and educationally.