BORROW

Mid-Market Lending Done Differently. Fast, Flexible and Transparent.

WHAT MAKES WOODBRIDGE DIFFERENT?

Every project is unique. Our loan products are designed to reflect that – offering solutions, not hurdles. Solving problems is what we do best.

WE FOCUS ON LOANS FROM $10 – $100 MILLION

Apartments / Townhouses

We provide tailored first mortgage loans for apartment and townhouse projects, supporting acquisition, construction, and completion with flexible structures, transparent terms, and reliable funding certainty.

Industrial / Logistics

We finance industrial and logistics facilities through acquisition, and construction, helping developers deliver warehouses, distribution centres, and modern logistics hubs with dependable capital solutions.

Retail

We offer first mortgage funding for retail assets including shopping centres, neighbourhood centres, and large format retail, providing flexible capital for acquisition, redevelopment, or repositioning.

Office

We provide office funding solutions for acquisition, refurbishment, or new development, with loan structures designed to support project delivery and maximise long-term asset performance.

Residual Stock

We provide residual stock loans against completed projects, unlocking equity in unsold units, enhancing developer cash flow, and creating certainty while awaiting final sales.

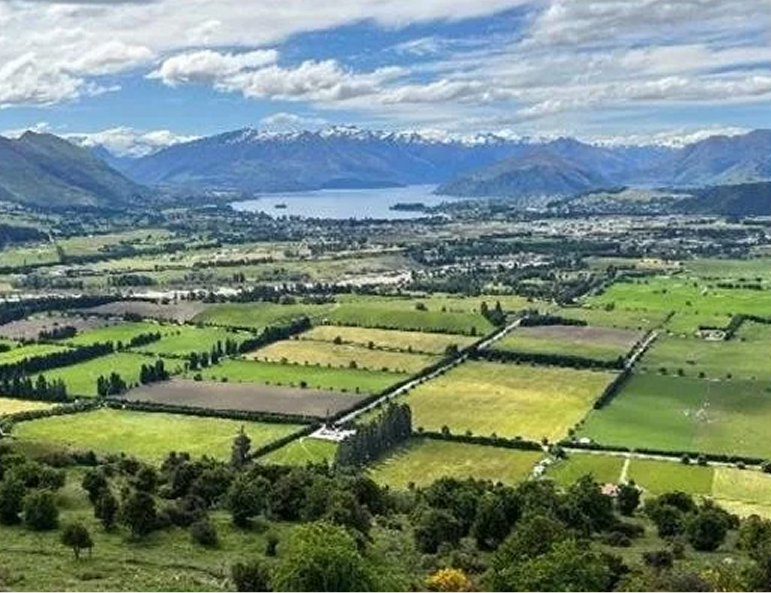

Land Subdivision

We offer structured loans for land subdivision, funding acquisition, planning, civil works, and staged delivery, supporting developers with reliable capital and flexible drawdown structures.

Build to Rent

We provide construction loans for build-to-rent projects, offering capital certainty and structured facilities that support delivery of stabilised rental portfolios with strong tenant demand.

Hotel

We finance hotel projects with first mortgage loans for acquisition, redevelopment, and construction, supporting operators and developers to realise opportunities in strong hospitality markets.

CONSTRUCTION SPECIALISTS

Woodbridge isn’t your typical construction lender. Our Managing Director, Andrew Torrington, brings more than 20 years’ experience in senior roles at Multiplex, Probuild, and Icon Kajima. Having worked as a developer, builder, and subcontractor, he offers insight few lenders can match.

We don’t just finance construction projects—we understand them. We know the risks and complexities firsthand, and when challenges arise, we stay calm, work collaboratively, and focus on solutions.

This borrower-first approach, backed by deep construction expertise, means faster decisions, clearer terms, and tailored facilities aligned to each project’s timelines and cash flows. The result: a trusted lending partner who sees success the way developers do.

NEWS

SEE ALLGET IN TOUCH

Melbourne

Sydney

Brisbane